Examiner’s Report Confirms That Celsius Operated Like A Ponzi Scheme

- The court-appointed independent examiner for Celsius’ bankruptcy case filed the final report earlier today.

- The report found that the bankrupt crypto lender used customer deposits to fund withdrawals on multiple occasions.

- Customer funds were also used to prop up the price of CEL, the lender’s native token.

- Founder and former CEO Alex Mashinsky cashed out over $68 million by inflating CEL’s price.

Shoba Pillay, the independent examiner who has been looking into Celsius’ finances and conduct, filed the final report in the U.S Bankruptcy Court for the Southern District of New York earlier today. The report was long-anticipated by customers of the bankrupt crypto lender and other stakeholders who have closely followed the developments in this high-profile bankruptcy case.

Celsius used customer deposits to fund withdrawals

In September 2022, bankruptcy Judge Martin Glenn appointed Pillay as the examiner to investigate several allegations made by Celsius’ customers and creditors. These included mismanagement of users’ funds and a potential Ponzi scheme at play. The examiner’s report found that the crypto lender misled its investors and customers by operating in a significantly different manner than the one laid out in its contract.

Furthermore, the examiner stated in the report that Celsius lacked the necessary risk management functions and the liquidity risk framework that a company of its size should have had in place.

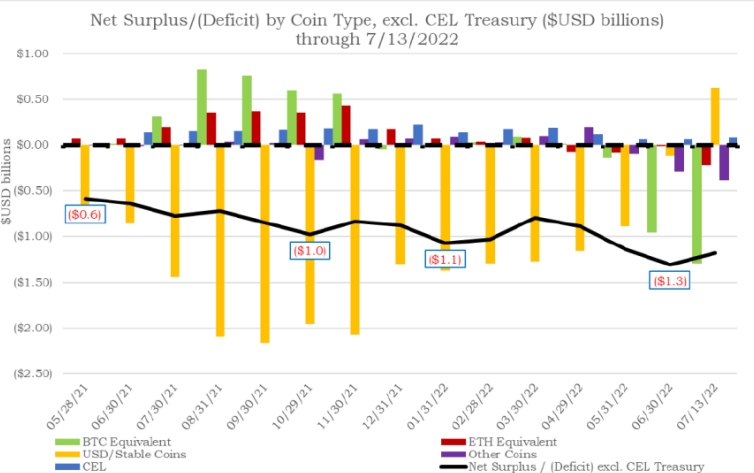

According to the examiner, Celsius used customer deposits to fund the mounting withdrawal requests in the run-up to the withdrawal halt in early June 2022. On multiple occasions, wallets that contained new user deposits were used to “top off” the frictional wallets that were used to facilitate customer withdrawals. Additionally, the processing of withdrawals despite the liquidity issues

“Celsius’s problems did not start in 2022. Rather, serious problems dated back to at least 2020, after Celsius started using customer assets to fund operational expenses and rewards”

Independent Examiner Shoba Pillay.

The report also shed light on the shady activities surrounding CEL, Celsius’ native token. Celsius posted customer deposits as collateral to take out stablecoin loans. These stablecoins were used to fund the company’s operations and to acquire BTC and ETH, which were subsequently used to fund CEL buybacks.

According to the examiner, Celsius repeatedly used stablecoins acquired through customer funds to prop up the price of CEL. In April 2022, Celsius’s Coin Deployment Specialist described Celsius’s practice of “using customer stable coins” and “growing short in customer coins” to buy CEL as “very ponzi like.” When asked by the company’s former Vice President of Treasury about the source of cash being used to fund CEL purchases, the Coin Deployment Specialist replied, “users like always.” The liquidity induced from these buybacks helped Celsius founder and former CEO Alex Mashinsky cash out more than $68 million through CEL sales.