Number of XRP Whales Holding 10M+ Coins Increased by 3.5% in Q1 2021

- Q1 2021 was a period of XRP accumulation by whales

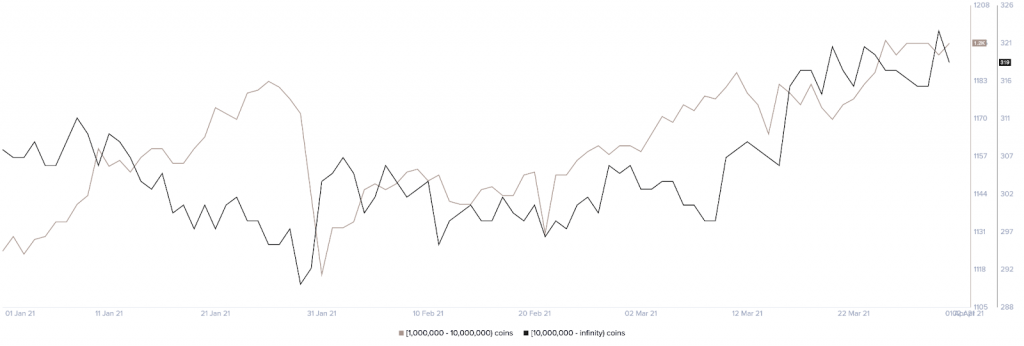

- The number of XRP whales holding 10 million or more coins increased from 308 to 319 in Q1

- The number of XRP whales holding between 1 million and 10 million increased from 1,125 to 1,196

- XRP ledger transactions increased by 23% in Q1 as unique addresses increased by 15%

Ripple has released its first quarterly XRP market report for 2021 in which they point out that Q1 was a strong one for XRP in terms of accumulation and on-chain metrics.

XRP Whales Have Been Busy Accumulating in Q1

To begin with, the number of XRP whales holding 10 million or more coins increased from 308 to 319. This is a 3.57% increment from the previous quarter. During the same time period, XRP whale wallets holding between 1 million to 10 million coins increased from 1,125 to 1,196 signifying a 6.3% increment quarter to quarter.

The increment of XRP whales during the first quarter of 2021 can be visualized through the following chart from the report.

XRP Payment Volume Increased by 23% and Ledger Accounts Increased by 15%

During the same time period, the transactional activity on the XRP ledger also grew significantly. According to the quarterly report, XRP ledger payment volume hit a total of $62.3 billion. This amount was a 23% increment from the previous quarter.

Additionally, the amount of unique XRP ledger addresses grew from 2.35 million to 2.7 million which is a 15% increment quarter to quarter.

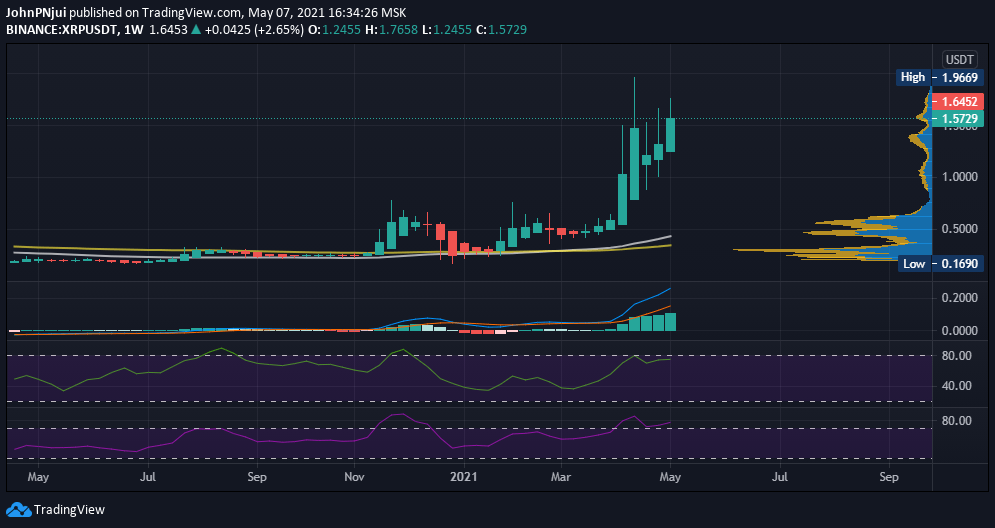

XRP’s $1.50 Support Continues to Hold, Weekly Chart Hints of Exhaustion

With respect to price, XRP is currently trading at $1.64 with the $1.50 price area providing considerable support into the weekend. On a macro-level, XRP’s bullish momentum could be coming to an end as seen through the following weekly chart.

From the chart, it can be observed that the weekly MACD is in overbought territory and hinting of a trend reversal in the weeks to follow. Secondly, the weekly MFI and RSI are also in overbought territory at values of 74 and 78 respectively. Thirdly, the price of XRP has deviated quite a bit from the 50-week moving average (white) further confirming an overbought scenario.

However, altcoins are currently enjoying a period of gains as the Bitcoin dominance has dropped below 50% and for the first time since December 2017. Therefore, alt season is in full swing and XRP might have enough fuel to propel it towards the $2 for a potential double top or even higher.

As with all analyses of altcoins such as XRP, traders and investors are advised to have an eye out for any sudden movement by Bitcoin – up or down – that might increase its dominance thus ruining alt-season.