Bitcoin (BTC) Price Prediction: BTC/USD Holds as Buyers Recoup Above $59,000 Support

Bitcoin (BTC) Price Prediction – April 11, 2021

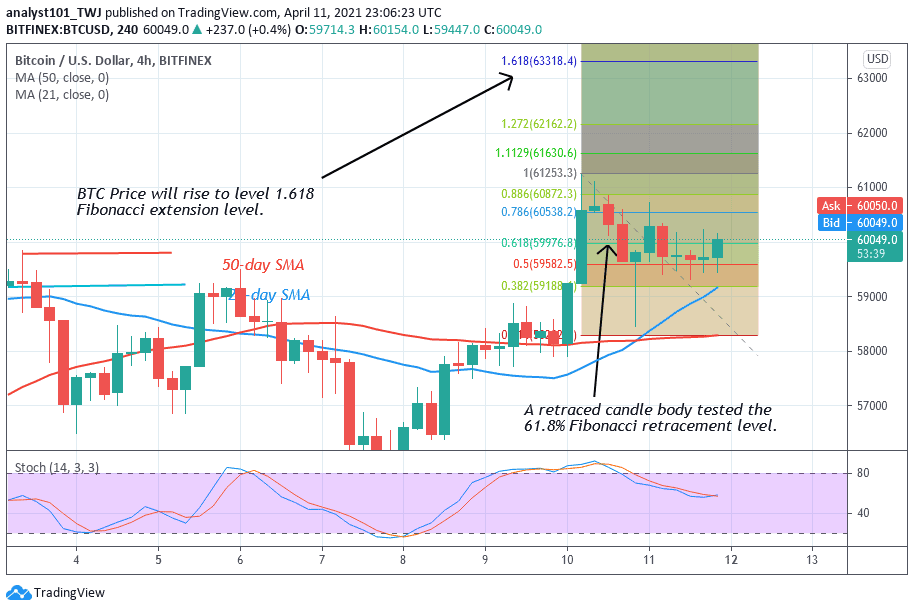

Bitcoin price is consolidating below the $60,000 overhead resistance. The price action is now characterized by small body candlesticks namely Doji and Spinning tops. These candlesticks are indicating that buyers and sellers are undecided about the direction of the market.

Resistance Levels: $58,000, $59,000, $60,000

Support Levels: $40,000, $39,000, $38,000

Following its failure to break the $60,000 psychological price level and subsequent price fall, BTC/USD is consolidating below the overhead resistance. After rejection at the recent high, BTC price fell to $58,450 support but pulled back. The market pulled back above the $58,000 support. This is a very crucial level as price will resume upside momentum. If the bears have succeeded in breaking below the $58,000 support, the selling pressure would have continued on the downside. Presently, Bitcoin has resumed consolidation above the $59,000 support. The price movement is in a stalemate as the price action is now characterized by small body candlesticks. Meanwhile, Bitcoin is trading at $59,555 at the time of writing.

Bitcoin (BTC) Indicator Reading

Bitcoin is presently below the 80% range of the daily stochastic. It indicates that the crypto is in a bearish momentum. Presently, the downward move has been stalled as price indicates small body indecisive candlesticks. BTC price is at level 55 of the Relative Strength index period14. This indicates that the king coin has enough room to rally on the upside.

Meanwhile, on April 10 uptrend; a retraced candle body tested the 61.8% Fibonacci retracement level. The retracement implies that Bitcoin will rise to level 1.618 Fibonacci extension. From the price action, the BTC price is still consolidating above the $59,000 support. Buyers will have to break the overhead resistance to attain the Fibonacci level.