Bitcoin Price Prediction: BTC/USD Trades Above $62,500 Resistance After A Sharp Sell-off

Bitcoin (BTC) Price Prediction – April 14

The daily chart reveals that Bitcoin (BTC) bulls still remain in control as the price heads toward a $63,000 resistance level.

BTC/USD Long-term Trend: Bullish (Daily Chart)

Key levels:

Resistance Levels: $69,000, $71,000, $73,000

Support Levels: $57,000, $55,000, $53,000

After trading close to the $61,000 support level, BTC/USD is seen following a bullish sentiment as the market price hits the daily high at $64,896 resistance. At the moment, the BTC price is trading around $62,632. However, bulls are gaining control of the market. It is important to realize that the market is still ready for further upside near to mid-term because the gap has not been filled.

Despite the Recent Selloff, BTC/USD Remains Above $62,000

At the moment, the buyers appeared to be gaining control of the market, if the bulls can manage to break above the upper boundary of the channel, the next buying pressure can be expected at $69,000, $71,000, and perhaps $73,000 resistance as the market is currently testing below the 70-level of the daily RSI (14). Meanwhile, a bounce below the moving averages could send the market to $57,000, $55,000, and $53,000 supports.

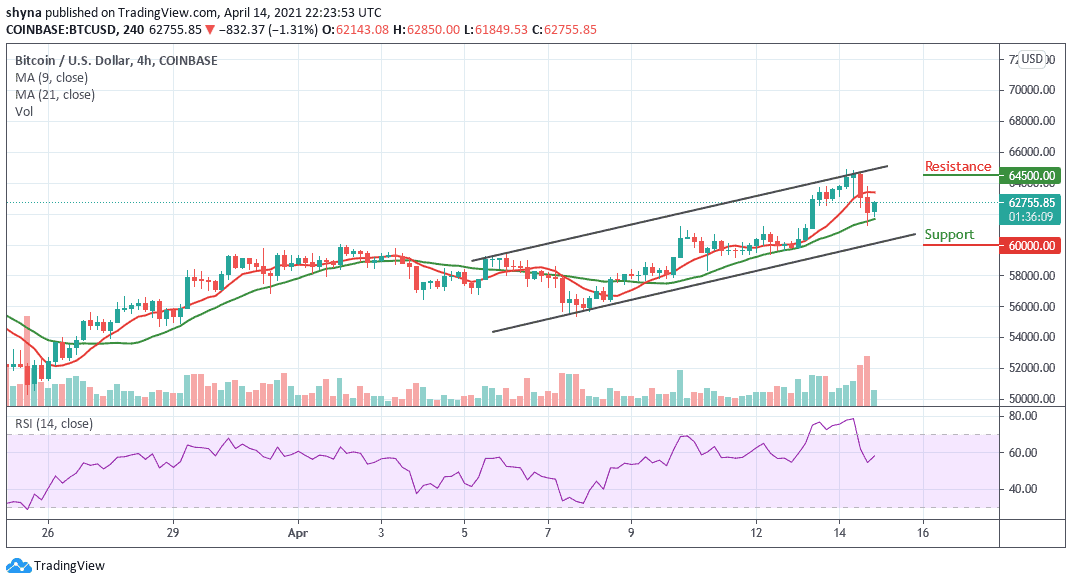

BTC/USD Medium-Term Trend: Bullish (4H Chart)

On the 4-hour chart, a retest of $62,700 gives the impression that bulls are not yet done. The Bitcoin price rises to fill a significant gap as the bulls remained in control which may take the coin towards the $64,000. In a short time, BTC/USD may hit $63,000 if the bullish pressure continues. Otherwise, the price may plummet to $60,000 and below.

On the upside, a bullish move may continue to meet resistance at around $64,500 and above. As of now, the 4-hours RSI (14) is coming out of the negative zone, now turning upward. This could mean that BTC/USD trading is looking for another close resistance. Meanwhile, a significant cross below the 50-level may send the market in a bearish scenario.